All State Insurance Prices: The Ultimate Guide To Get The Best Rates

Are you tired of feeling like you're overpaying for your All State insurance? Well, you're not alone. Many folks out there are scratching their heads, wondering if they're really getting the best deal possible. Let's face it, insurance prices can be a real head-scratcher, but don’t stress—we’ve got your back! In this article, we’re going deep into the world of All State insurance prices, breaking it all down so you can make smarter choices.

Insurance isn’t exactly the most exciting topic in the world, but hey, it’s super important. Whether you’re a first-time buyer or someone looking to switch policies, understanding how All State insurance prices work is key. You don’t want to end up paying more than you should, right? So, let’s roll up our sleeves and dive into the nitty-gritty of it all.

By the time you’re done reading this, you’ll have a clearer picture of what factors influence All State insurance prices, how to compare them, and most importantly, how to save some serious cash. Stick around, because this is gonna be good!

Read also:Embracing Excellence The Essence Of Whatever You Are Be A Good One Quote

Understanding All State Insurance Prices

What Exactly Are All State Insurance Prices?

Alright, let’s start with the basics. All State insurance prices refer to the amount of money you pay for your insurance coverage through All State. It’s like a monthly or yearly fee that ensures you’re protected in case something unexpected happens, like a car accident, a fire, or even a burglary. But here’s the kicker—these prices can vary wildly depending on a bunch of different factors.

Think of it like shopping for a new phone. You might see the same model at different stores with different prices. Similarly, two people with similar coverage might pay completely different amounts for their All State insurance. Why is that? Well, we’ll get into that in just a sec.

Factors That Affect All State Insurance Prices

Age and Gender

One of the first things that insurance companies look at is your age and gender. Younger drivers, especially those under 25, tend to pay more because they’re considered higher risk. Same goes for males in certain age groups. It’s not exactly fair, but that’s how the system works. On the flip side, as you get older and gain more experience, your rates might start to drop.

Driving Record

Your driving record plays a huge role in determining your All State insurance prices. If you’ve got a clean record with no accidents or traffic violations, you’re golden. But if you’ve got a few dings here and there, you might end up paying more. It’s like a report card for your driving skills, and insurers use it to gauge how risky you are to insure.

Location

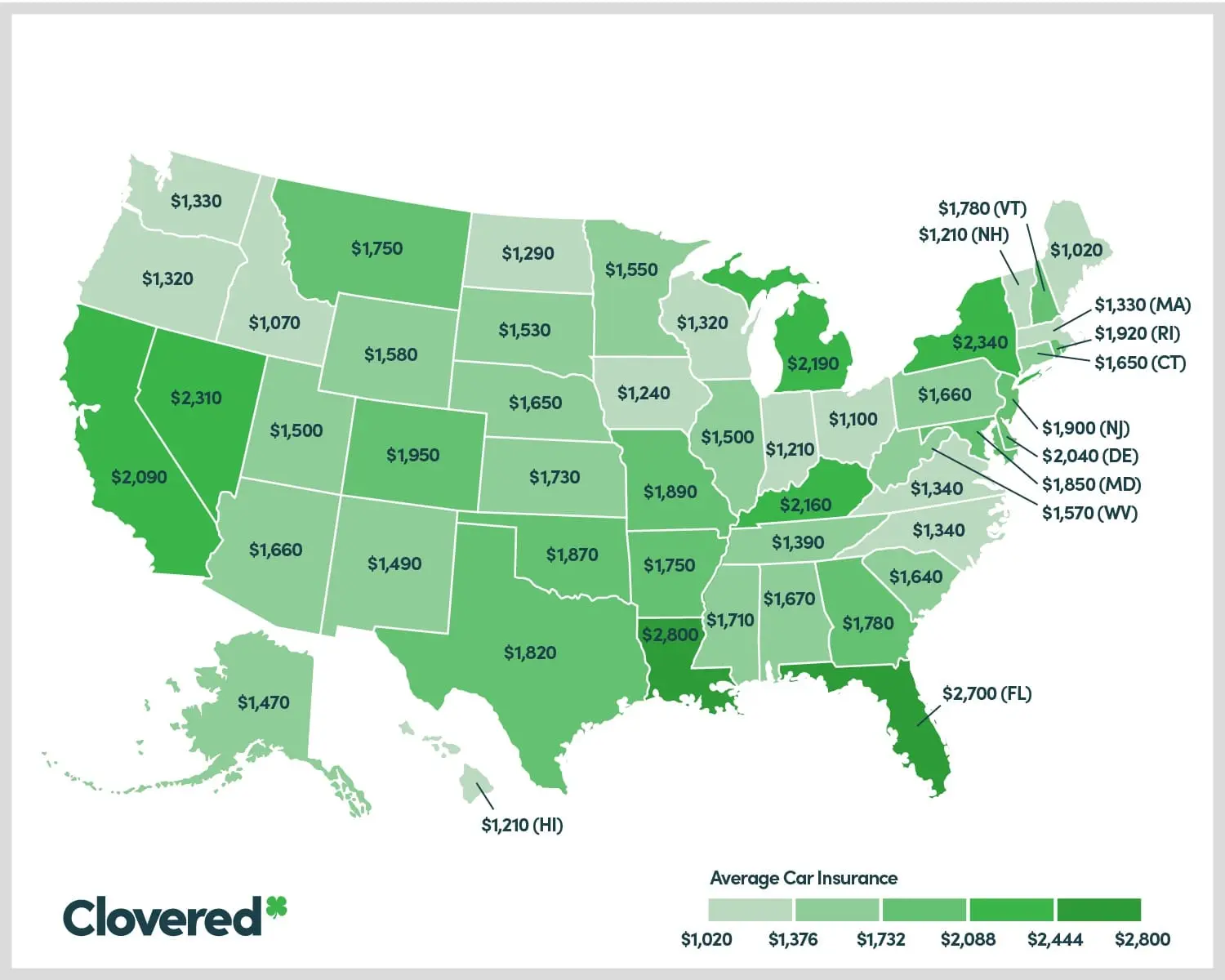

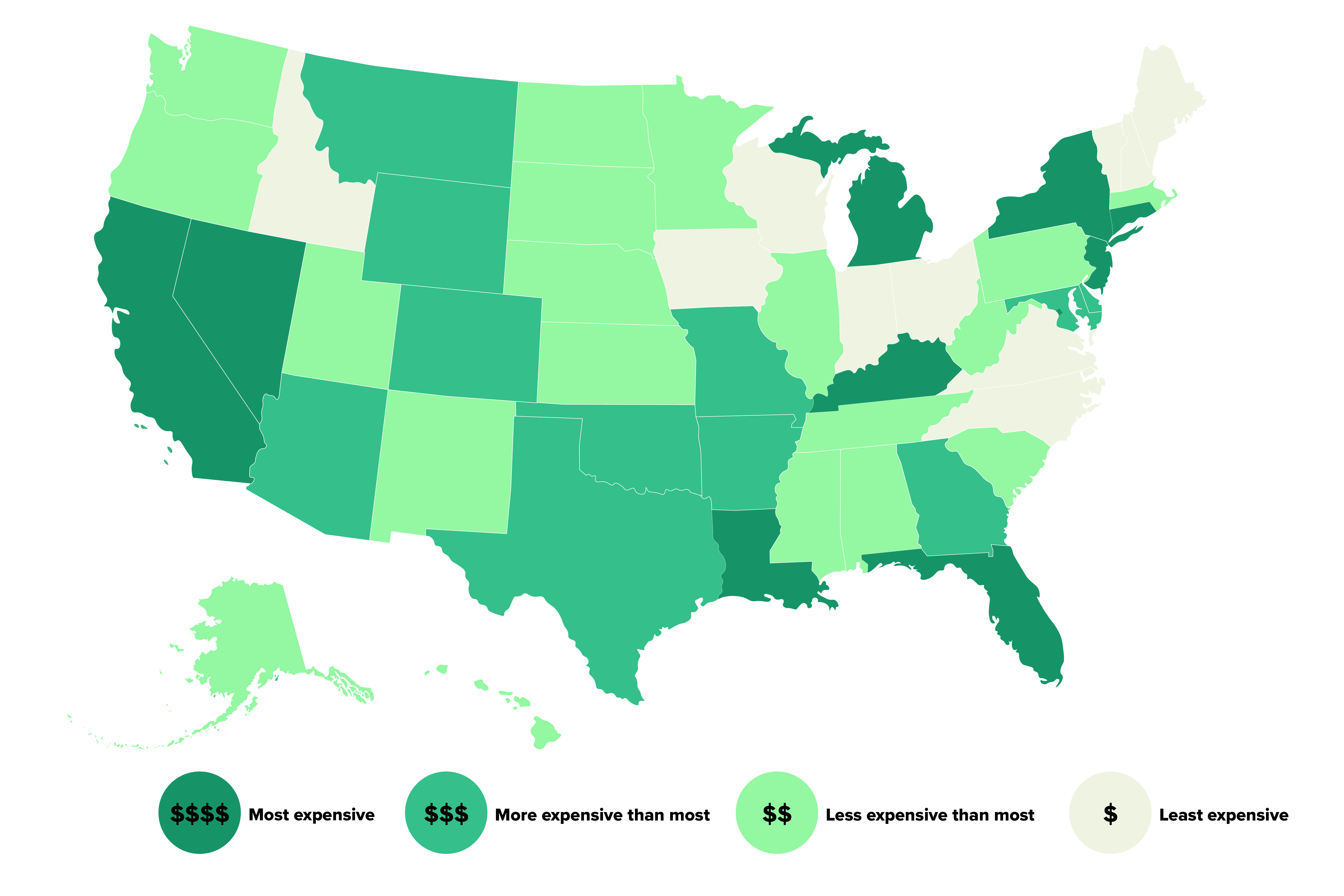

Where you live also affects your All State insurance prices. If you’re in a big city with lots of traffic and higher crime rates, you’ll probably pay more. On the other hand, if you live in a small town or a rural area, your rates might be lower. Location matters because it impacts the likelihood of accidents and theft.

Comparing All State Insurance Prices

Why Comparison Matters

Comparing All State insurance prices is crucial if you want to get the best deal. Just because you’ve been with the same provider for years doesn’t mean you’re getting the best rates. Shopping around and comparing quotes can save you hundreds, if not thousands, of dollars a year. Plus, it’s easier than ever to do with all the online tools available.

Read also:Exploring The Allure Of Marcela Latin Babe A Comprehensive Dive

Think of it like buying a house. You wouldn’t just settle for the first one you see without checking out a few others, right? The same logic applies to insurance. Take the time to compare, and you’ll be glad you did.

Tips to Lower All State Insurance Prices

Bundle Your Policies

One of the easiest ways to lower your All State insurance prices is by bundling your policies. If you’ve got both car insurance and homeowners insurance, combining them under one provider can often lead to significant savings. It’s like a two-for-one deal, and All State loves rewarding loyal customers.

Take Advantage of Discounts

Did you know that All State offers a ton of discounts? From safe driver discounts to good student discounts, there’s something for everyone. Make sure you’re taking full advantage of all the discounts available to you. It’s like leaving money on the table if you don’t!

Increase Your Deductible

Another way to lower your All State insurance prices is by increasing your deductible. Now, this might not be the best option for everyone, but if you’re comfortable paying a bit more out of pocket in case of an accident, it can save you a ton of money in the long run. Just make sure you’ve got the savings to back it up.

Common Misconceptions About All State Insurance Prices

Myth: All Policies Are the Same

One of the biggest misconceptions about All State insurance prices is that all policies are the same. Wrong! Different policies offer different levels of coverage, and the prices can vary significantly. It’s important to understand exactly what you’re getting for your money and tailor your coverage to fit your needs.

Myth: Lower Prices Always Mean Better Deals

Another common myth is that lower prices always mean better deals. Not necessarily. Sometimes, a cheaper policy might come with less coverage or higher deductibles. Always read the fine print and make sure you’re comparing apples to apples when shopping for insurance.

Data and Statistics on All State Insurance Prices

Industry Trends

According to recent data, All State is one of the largest insurance providers in the U.S., serving millions of customers across the country. On average, customers pay anywhere from $800 to $1,500 per year for their All State insurance, depending on various factors. But these numbers can fluctuate based on market trends and individual circumstances.

For example, in 2022, there was a noticeable increase in insurance prices due to rising repair costs and inflation. This trend is expected to continue in the coming years, so it’s more important than ever to stay informed and shop smart.

How to Choose the Right All State Insurance Plan

Evaluate Your Needs

Choosing the right All State insurance plan starts with evaluating your needs. Ask yourself what kind of coverage you need and how much you’re willing to pay. Do you need basic liability coverage, or do you want comprehensive protection? Understanding your priorities will help you make a more informed decision.

Read the Fine Print

Always take the time to read the fine print before signing up for any insurance plan. This will help you avoid any nasty surprises down the road. Look for things like exclusions, limitations, and any additional fees that might not be immediately obvious.

Customer Reviews and Feedback

What Customers Are Saying

Customer reviews can be a great way to gauge the quality of All State insurance prices and service. While individual experiences may vary, overall, All State tends to receive positive feedback for its customer service and claims handling. However, some customers have reported issues with pricing transparency, so it’s always a good idea to do your own research.

Conclusion

So, there you have it—everything you need to know about All State insurance prices. From understanding the factors that affect your rates to comparing quotes and finding discounts, there’s a lot to consider when it comes to getting the best deal. But with a little effort and some smart shopping, you can save yourself a ton of money.

Don’t just sit there—take action! Compare quotes, explore discounts, and make sure you’re getting the coverage you need at a price that works for you. And if you’ve got any questions or thoughts, feel free to drop a comment below. Let’s keep the conversation going!

Oh, and before you go, make sure to check out some of our other articles for more tips and tricks on saving money and making smart financial decisions. You won’t regret it!

Table of Contents

- Understanding All State Insurance Prices

- Factors That Affect All State Insurance Prices

- Comparing All State Insurance Prices

- Tips to Lower All State Insurance Prices

- Common Misconceptions About All State Insurance Prices

- Data and Statistics on All State Insurance Prices

- How to Choose the Right All State Insurance Plan

- Customer Reviews and Feedback

- Conclusion