Cobb Property Tax Records: Your Ultimate Guide To Understanding And Managing Taxes

Hey there, tax-savvy friend! Ever wondered how Cobb property tax records work or why they matter so much? Well, buckle up because we’re diving deep into the world of property taxes in Cobb County. Whether you’re a homeowner, investor, or just someone curious about how these records impact your wallet, this guide’s got you covered. Cobb property tax records aren’t just numbers on a page—they’re crucial tools for managing your finances and understanding your property’s value.

Property taxes can feel overwhelming, especially when you’re dealing with records, assessments, and payments. But fear not! This article is designed to break it all down for you in simple, relatable terms. Think of it as a one-stop shop for everything Cobb property tax records. From how they’re calculated to where you can access them, we’ve got the lowdown.

Now, here’s the deal: property taxes affect everyone who owns land or a home. Cobb County has its own set of rules, deadlines, and resources to help you navigate this process. By the time you finish reading, you’ll be armed with knowledge that could save you money and headaches. So, let’s get started!

Read also:John Dark Souls The Ultimate Guide To A Gaming Legend

What Are Cobb Property Tax Records Anyway?

Let’s start with the basics, shall we? Cobb property tax records refer to the official documentation of property assessments, tax liabilities, and payment histories in Cobb County. These records are maintained by the Cobb County Tax Commissioner’s Office and are publicly accessible. Think of them as the blueprint for how much you owe in property taxes each year.

But why are they important? Well, Cobb property tax records serve multiple purposes. They help determine your property’s market value, ensure fair taxation across the board, and provide a transparent system for homeowners to understand their obligations. Plus, they’re essential for anyone looking to buy or sell property in Cobb County.

Here’s the kicker: understanding these records isn’t just about knowing what you owe. It’s also about spotting errors, disputing unfair assessments, and taking advantage of exemptions or deductions. And trust me, those little details can add up to big savings.

How Cobb Property Tax Records Are Calculated

Okay, so how do they come up with those numbers on your tax bill? Cobb property tax records are calculated using a few key factors:

- Property Assessment: This is the estimated market value of your property as determined by the Cobb County Tax Assessor.

- Tax Rate: Also known as the millage rate, this is the rate applied to your property’s assessed value to calculate your tax bill.

- Exemptions and Deductions: Certain properties qualify for reductions in their taxable value, such as homestead exemptions or senior citizen discounts.

The formula looks something like this: Assessed Value × Tax Rate = Tax Bill. Easy, right? Well, kinda. The devil’s in the details, and that’s where things can get tricky. For example, if your property’s assessed value increases significantly, your tax bill could skyrocket unless you challenge the assessment.

Common Factors Affecting Property Assessments

Several factors can influence your property’s assessed value:

Read also:What Is Mary Trumps Net Worth In 2023 A Comprehensive Guide

- Location: Properties in more desirable neighborhoods tend to have higher assessments.

- Improvements: Adding a pool, renovating your kitchen, or expanding your home can boost your property’s value—and your tax bill.

- Market Conditions: If property values in Cobb County are rising overall, your assessment might increase as well.

It’s worth noting that the Cobb County Tax Assessor conducts regular reassessments to ensure values stay current. So, even if your tax bill hasn’t changed much in the past, it could fluctuate based on these factors.

Where to Find Cobb Property Tax Records

Accessing Cobb property tax records is easier than you might think. The Cobb County Tax Commissioner’s Office provides several ways to view and manage your records:

Online Portal: Visit the Cobb County Tax Commissioner’s website and log in to your account. You’ll find detailed information about your property’s assessed value, tax history, and payment status. Plus, you can make payments directly through the portal.

In Person: If you prefer the old-school approach, you can visit the Cobb County Tax Commissioner’s Office during business hours. Bring your property ID number and any relevant documents for a smoother experience.

Phone Support: Need a quick answer? Call the Tax Commissioner’s office and speak to a representative. They can help you with everything from clarification on your bill to assistance with disputes.

Pro tip: Bookmark the online portal for easy access. It’s a lifesaver during tax season!

Tips for Navigating the Online Portal

Here’s how to make the most of the Cobb County Tax Commissioner’s online portal:

- Create an account if you haven’t already. It’s free and takes just a few minutes.

- Check your property’s assessed value and compare it to recent sales in your area.

- Set up automatic payment reminders to avoid late fees.

- Download copies of your tax bills and payment receipts for your records.

By staying organized and proactive, you can save yourself a lot of stress come tax time.

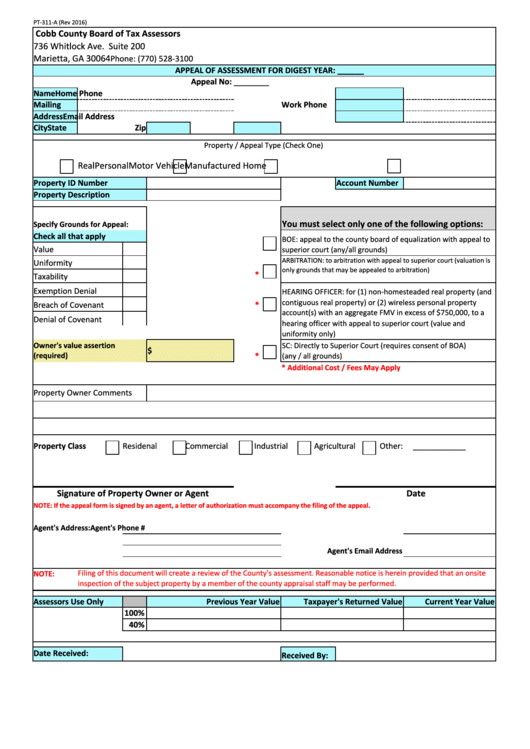

Challenging Cobb Property Tax Assessments

Think your property’s assessed value is too high? You’re not alone. Many homeowners in Cobb County challenge their assessments each year. Here’s how you can do it:

Step 1: Gather Evidence – Collect data on comparable properties in your area, recent sales, and any factors that might lower your property’s value (e.g., structural issues or market decline).

Step 2: File a Formal Appeal – Submit your appeal to the Cobb County Board of Tax Assessors within the specified timeframe. Be sure to include all supporting documentation.

Step 3: Attend a Hearing – If your appeal requires a hearing, be prepared to present your case clearly and persuasively.

Remember, challenging an assessment isn’t always easy, but it can pay off big time. According to the National Taxpayers Union, about 60% of appeals result in reduced assessments. So, it’s definitely worth the effort.

Common Reasons for Successful Appeals

Here are some of the most common reasons homeowners win their appeals:

- Incorrect property details (e.g., square footage or number of bedrooms).

- Overestimated market value compared to similar properties.

- Undervalued property features or defects.

Doing your homework and presenting a strong case can significantly increase your chances of success.

Understanding Property Tax Exemptions in Cobb County

Did you know that certain homeowners in Cobb County qualify for property tax exemptions? These exemptions reduce your taxable value, potentially saving you hundreds or even thousands of dollars each year. Here’s a rundown of the most common ones:

- Homestead Exemption: Available to homeowners who use their property as their primary residence.

- Senior Citizen Exemption: For homeowners aged 62 and older, this exemption offers additional savings.

- Disabled Veteran Exemption: Provides relief for veterans with service-connected disabilities.

To apply for an exemption, visit the Cobb County Tax Assessor’s website and complete the necessary forms. Be sure to submit them by the deadline to avoid missing out on potential savings.

How to Apply for Exemptions

Applying for property tax exemptions is straightforward:

- Download the application form from the Tax Assessor’s website.

- Fill out the form and attach any required documentation (e.g., proof of age or disability).

- Submit the completed application by the deadline.

Once approved, your exemption will be reflected on your next tax bill. It’s a simple process that can yield big rewards.

Common Mistakes to Avoid with Cobb Property Tax Records

Even the savviest homeowners can make mistakes when dealing with property taxes. Here are a few pitfalls to watch out for:

- Ignoring Assessment Notices: Don’t toss those notices aside. They contain important information about your property’s value and potential changes to your tax bill.

- Missing Payment Deadlines: Late payments incur penalties and interest, so set reminders to stay on track.

- Failing to Update Your Records: If you’ve made improvements or repairs to your property, notify the Tax Assessor to ensure accurate assessments.

Avoiding these mistakes can save you time, money, and frustration. Stay informed and proactive, and you’ll be ahead of the game.

Staying Up-to-Date with Tax Changes

Property tax laws and regulations can change from year to year. To stay informed:

- Subscribe to the Cobb County Tax Commissioner’s newsletter for updates.

- Follow local news sources for announcements about tax rate changes or new programs.

- Attend town hall meetings or public forums to voice your concerns and learn more.

Knowledge is power, especially when it comes to property taxes.

Resources for Managing Cobb Property Tax Records

Need a little extra help? Here are some resources to assist you with Cobb property tax records:

- Cobb County Tax Commissioner’s Website: The go-to source for all things property tax-related.

- Local Tax Professionals: Hire a tax expert familiar with Cobb County regulations for personalized guidance.

- Online Forums and Communities: Connect with other homeowners for tips and advice.

Don’t hesitate to reach out for assistance. Managing property taxes doesn’t have to be a solo endeavor.

When to Seek Professional Help

Sometimes, it pays to bring in the experts. Consider consulting a tax professional if:

- You’re unsure about how to challenge an assessment.

- You need help navigating complex exemption rules.

- You want to ensure compliance with all local and state regulations.

Professionals can save you time and money in the long run, so don’t shy away from seeking their expertise.

Kesimpulan: Take Control of Your Cobb Property Tax Records

Alright, let’s recap: Cobb property tax records are a critical part of homeownership, affecting everything from your tax bill to your property’s value. By understanding how they’re calculated, accessing them easily, and taking advantage of exemptions, you can manage your taxes more effectively.

Remember, knowledge is your best weapon against high property taxes. Stay informed, challenge unfair assessments, and don’t be afraid to seek help when needed. And hey, if you found this guide helpful, drop a comment below or share it with your fellow property owners. Together, we can demystify the world of Cobb property tax records!

Call to Action

Ready to take charge of your property taxes? Start by visiting the Cobb County Tax Commissioner’s website today. While you’re at it, check out our other articles for more tips and insights on managing your finances. Let’s make property ownership less stressful and more rewarding—one tax record at a time!