Fulton County Tax Assessor Atlanta GA: Your Ultimate Guide To Property Taxes

So, you're probably wondering about Fulton County tax assessor in Atlanta, GA, right? Well, let me break it down for ya. Property taxes can be a real head-scratcher, but don't sweat it. This guide is here to help you understand everything from assessments to payments and all the nitty-gritty details in between. Whether you're a homeowner, a buyer, or just curious, we've got you covered.

Let's face it, property taxes are one of those things that everyone has to deal with eventually. Fulton County, being the heart of Atlanta, has its own unique system when it comes to assessing property values. And trust me, knowing how this system works can save you a ton of headaches and maybe even some cash.

Now, before we dive deep into the world of Fulton County tax assessors, let's get one thing straight. This isn't just about numbers and paperwork. It's about understanding your rights as a property owner and making sure you're not overpaying or missing out on any deductions. So, grab a cup of coffee, and let's get started!

Read also:Understanding Gen Pop Prison Meaning A Comprehensive Guide

Understanding Fulton County Tax Assessor

What Exactly is a Tax Assessor?

Alright, so what does a tax assessor do? Think of them as the folks who figure out how much your property is worth for tax purposes. In Fulton County, the tax assessor's office is responsible for evaluating all real estate and personal property within the county. They take into account factors like location, size, and improvements to determine the assessed value of your property.

Here's the kicker: the assessed value is not the same as the market value. The tax assessor uses a formula to calculate the assessed value, which is then used to determine how much property tax you owe. It's like a game of numbers, but don't worry, we'll break it down for you.

The Role of Fulton County Tax Assessor in Atlanta GA

Now, let's talk about Fulton County specifically. The tax assessor's office here plays a crucial role in maintaining the local economy. By accurately assessing property values, they ensure that the county has enough revenue to fund public services like schools, parks, and infrastructure. It's a big responsibility, and they take it seriously.

One interesting fact is that Fulton County uses a mix of automated systems and human expertise to conduct assessments. This ensures that the process is both efficient and accurate. Plus, they're always looking for ways to improve, which is a good sign for property owners.

How Property Taxes are Calculated in Fulton County

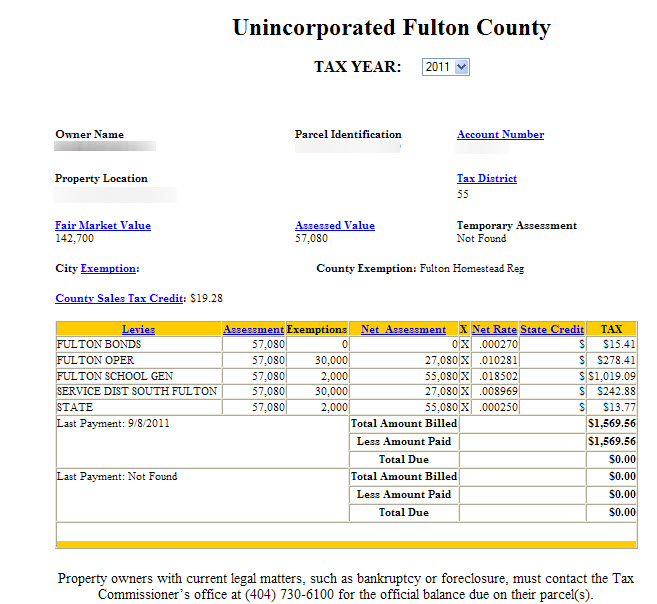

So, how do they come up with the amount you owe? It's actually a pretty straightforward process. The tax assessor calculates your property's assessed value, which is a percentage of the market value. Then, they multiply that by the current tax rate to determine your tax bill.

For example, if your property's market value is $300,000 and the assessed value is 40%, your assessed value would be $120,000. If the tax rate is 1%, your tax bill would be $1,200. Easy peasy, right?

Read also:Discover Mr Dragon Noodle House Authentic Asian Cuisine At Its Finest

Factors Affecting Property Tax Rates

Of course, there are a few factors that can affect your tax rate. These include:

- Location: Properties in certain areas may have higher tax rates due to increased demand and services.

- Improvements: Adding a pool or renovating your kitchen can increase your property's assessed value.

- Economic Conditions: The overall health of the economy can impact property values and tax rates.

It's important to keep these factors in mind when planning your budget. You never know what might pop up and affect your tax bill.

Steps to Check Your Property Tax Assessment

Curious about your own property tax assessment? Here's how you can check it out:

Using the Fulton County Tax Assessor's Website

Head over to the Fulton County tax assessor's website and enter your property address. You'll be able to see your assessed value, tax bill, and any exemptions you might qualify for. It's a quick and easy way to stay informed.

One cool feature is the ability to compare your property to others in the area. This can give you a better idea of whether your assessment is fair or if you might need to appeal.

Visiting the Tax Assessor's Office

If you prefer the old-school approach, you can always visit the tax assessor's office in person. They're located in downtown Atlanta, and the staff is usually pretty helpful. Just be sure to bring any documents you might need, like your property deed or previous tax bills.

Plus, visiting in person can give you a chance to ask questions and get a more personal touch. Sometimes, talking to someone face-to-face can make all the difference.

Appealing Your Property Tax Assessment

Think your assessment might be a bit off? You have the right to appeal. Here's how:

Gather Your Evidence

Before you file an appeal, make sure you have all your ducks in a row. Collect any documents that support your case, such as recent appraisals, photos of your property, or comparisons to similar properties in the area.

It's also a good idea to write a summary of your argument. This will help you stay organized and make your case more clearly.

Filing the Appeal

Once you're ready, submit your appeal to the Fulton County Board of Tax Assessors. They'll review your case and may even schedule a hearing. Be prepared to present your evidence and explain why you believe the assessment is incorrect.

Remember, appealing your assessment doesn't guarantee a lower tax bill, but it's definitely worth a shot if you think the current assessment is unfair.

Exemptions and Deductions You Should Know About

Now, here's the good news: there are some exemptions and deductions that can lower your property tax bill. Let's take a look:

Homestead Exemption

If your primary residence is in Fulton County, you might qualify for the homestead exemption. This reduces the assessed value of your property, which in turn lowers your tax bill. It's like a little gift from the county to help homeowners out.

To apply, simply fill out the form on the tax assessor's website or visit their office. Make sure you meet the eligibility requirements, like owning and occupying the property as your primary residence.

Senior Citizen Exemption

Senior citizens may also qualify for additional exemptions. These can further reduce your tax burden, which is a big help for those on a fixed income. Again, check the requirements and apply if you're eligible.

It's always a good idea to explore all your options when it comes to exemptions and deductions. You never know what you might find.

Common Misconceptions About Property Taxes

Let's clear up a few myths about property taxes in Fulton County:

Myth #1: Property Taxes Never Go Down

Wrong! Property taxes can actually decrease if the assessed value of your property drops. This might happen if the market value declines or if you successfully appeal your assessment.

So, don't assume your tax bill will only go up. Keep an eye on your assessment and be ready to act if you think it's unfair.

Myth #2: You Can't Negotiate Your Tax Bill

Actually, you can! While the tax rate is set by the county, you can negotiate your assessed value through the appeal process. It's not as straightforward as haggling at a flea market, but it's still a form of negotiation.

Just be prepared to make a strong case and back it up with evidence. The tax assessor's office is more likely to listen if you come armed with facts.

How to Stay Updated on Property Tax Changes

Property tax laws and rates can change from year to year, so it's important to stay informed. Here are a few tips:

Sign Up for Alerts

Most counties, including Fulton, offer email or text alerts for property tax updates. This can help you stay on top of any changes that might affect your bill.

Plus, it's a great way to avoid any unpleasant surprises when tax season rolls around.

Follow Local News

Local news outlets often cover property tax issues, especially if there are significant changes or controversies. Keep an eye on their websites or social media pages for the latest updates.

Being informed is half the battle, so make it a habit to stay in the loop.

Conclusion

Alright, that's the scoop on Fulton County tax assessor in Atlanta, GA. Whether you're a seasoned homeowner or a first-time buyer, understanding property taxes is key to managing your finances. By knowing how assessments are calculated, how to appeal if necessary, and what exemptions you might qualify for, you can take control of your tax situation.

So, what's next? We encourage you to check out your own property assessment, explore any available exemptions, and stay informed about changes in the law. And don't forget to share this guide with anyone who might find it helpful. Together, we can make property taxes a little less intimidating.

Thanks for reading, and remember: knowledge is power!

Table of Contents

- Fulton County Tax Assessor Atlanta GA: Your Ultimate Guide to Property Taxes

- Understanding Fulton County Tax Assessor

- What Exactly is a Tax Assessor?

- The Role of Fulton County Tax Assessor in Atlanta GA

- How Property Taxes are Calculated in Fulton County

- Factors Affecting Property Tax Rates

- Steps to Check Your Property Tax Assessment

- Using the Fulton County Tax Assessor's Website

- Visiting the Tax Assessor's Office

- Appealing Your Property Tax Assessment

- Gather Your Evidence

- Filing the Appeal

- Exemptions and Deductions You Should Know About

- Homestead Exemption

- Senior Citizen Exemption

- Common Misconceptions About Property Taxes

- Myth #1: Property Taxes Never Go Down

- Myth #2: You Can't Negotiate Your Tax Bill

- How to Stay Updated on Property Tax Changes

- Sign Up for Alerts

- Follow Local News

- Conclusion